About Dinarak®

OUR COMPANY

Dinarak was established in 2014 in order to become a licensed payment services provider under the Central Bank of Jordan's innovative 'JoMoPay' system.

Dinarak aims to be the lowest cost solution in the market, with the simplest systems (to work even with basic mobile handsets) and with the most extensive network of physical agents nationwide.

The company was awarded a full license from the Central Bank in 2016, and is uniquely focused on building an offering, brand and network that directly targets the financially excluded.

The company was awarded a full license from the Central Bank in 2016, and is uniquely focused on building an offering, brand and network that directly targets the financially excluded.

OUR MISSION

To build a mobile payments business that provides millions of unbanked people in Jordan with access to financial services, and transforms lives through financial inclusion.

The company will achieve this by:

• Building a service offering and brand that resonates with the financially excluded, providing a simple, convenient, trustworthy and reliable customer experience.

• Pursuing an aggressive growth strategy, in order to bring financial services to as many people as possible across the country, and to benefit from improved economies of scale.

• Establishing and expanding the network of merchants subscribing to the system, thereby building the opportunities for customers to utilize and benefit from mobile payments.

• Establishing and expanding a network of physical agents’ outlets, to provide widespread geographical coverage and accessibility to Dinarak services.

• Continually seeking to reduce costs while maintaining service quality, and translating that into price leadership - offering the most affordable service in the market.

• Heavily reinvesting in early stages to improve operational efficiency.

The company will achieve this by:

• Building a service offering and brand that resonates with the financially excluded, providing a simple, convenient, trustworthy and reliable customer experience.

• Pursuing an aggressive growth strategy, in order to bring financial services to as many people as possible across the country, and to benefit from improved economies of scale.

• Establishing and expanding the network of merchants subscribing to the system, thereby building the opportunities for customers to utilize and benefit from mobile payments.

• Establishing and expanding a network of physical agents’ outlets, to provide widespread geographical coverage and accessibility to Dinarak services.

• Continually seeking to reduce costs while maintaining service quality, and translating that into price leadership - offering the most affordable service in the market.

• Heavily reinvesting in early stages to improve operational efficiency.

OUR ROLE

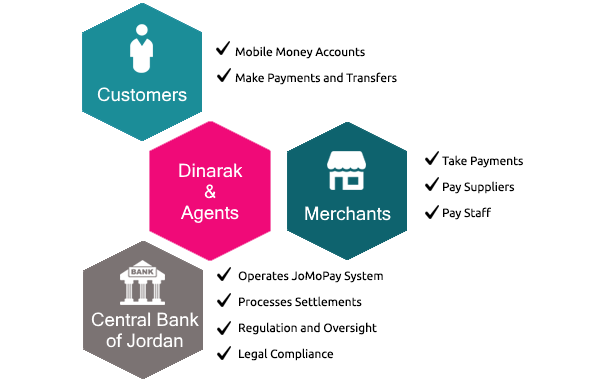

As a mobile payment services provider, DINARAK connects various groups in the mobile money system and enables the transactions to take place.

Through the DINARAK agent network, we provide mobile money accounts for customers to make payments and transfers. Merchants can take payments through their DINARAK accounts – and also use them to pay staff and suppliers.

And connecting to the Central Bank’s JoMoPay system means that payments are settled within a strict regulatory framework, so the whole process is fully assured.

Through the DINARAK agent network, we provide mobile money accounts for customers to make payments and transfers. Merchants can take payments through their DINARAK accounts – and also use them to pay staff and suppliers.

And connecting to the Central Bank’s JoMoPay system means that payments are settled within a strict regulatory framework, so the whole process is fully assured.